February 2025 Update

Making The News

1. Tit for Tariff

The month began with President Trump imposing a 10% tariff on all Chinese imports, followed by an additional 10% levy. In response, China pledged to impose tariffs of 10-15% on American agricultural and energy products. However, China’s retaliatory measures are limited to $20 billion worth of U.S. imports, whereas $440 billion of Chinese goods are now subject to U.S. tariffs. Meanwhile, Trump escalated trade tensions by implementing a 25% tariff on imports from Canada and Mexico, citing concerns over fentanyl trade. This move affects a combined $900 billion worth of U.S. imports from it’s neighbours.

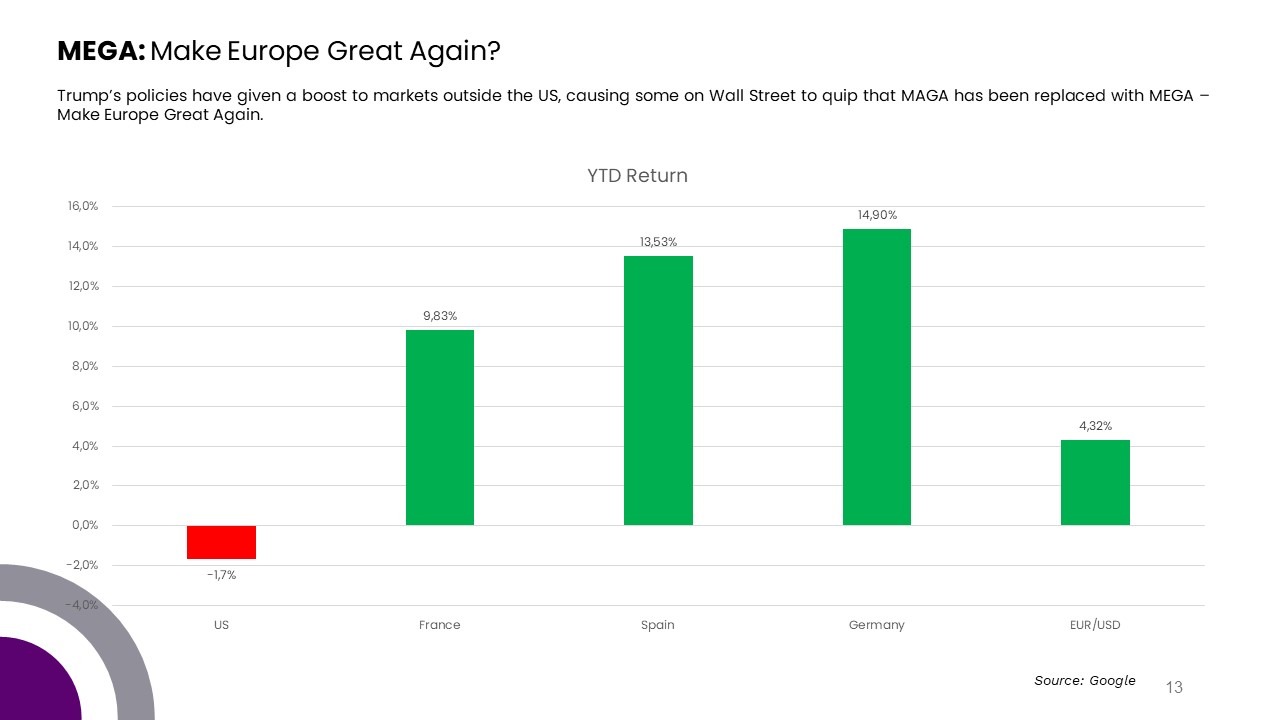

- European resurgence

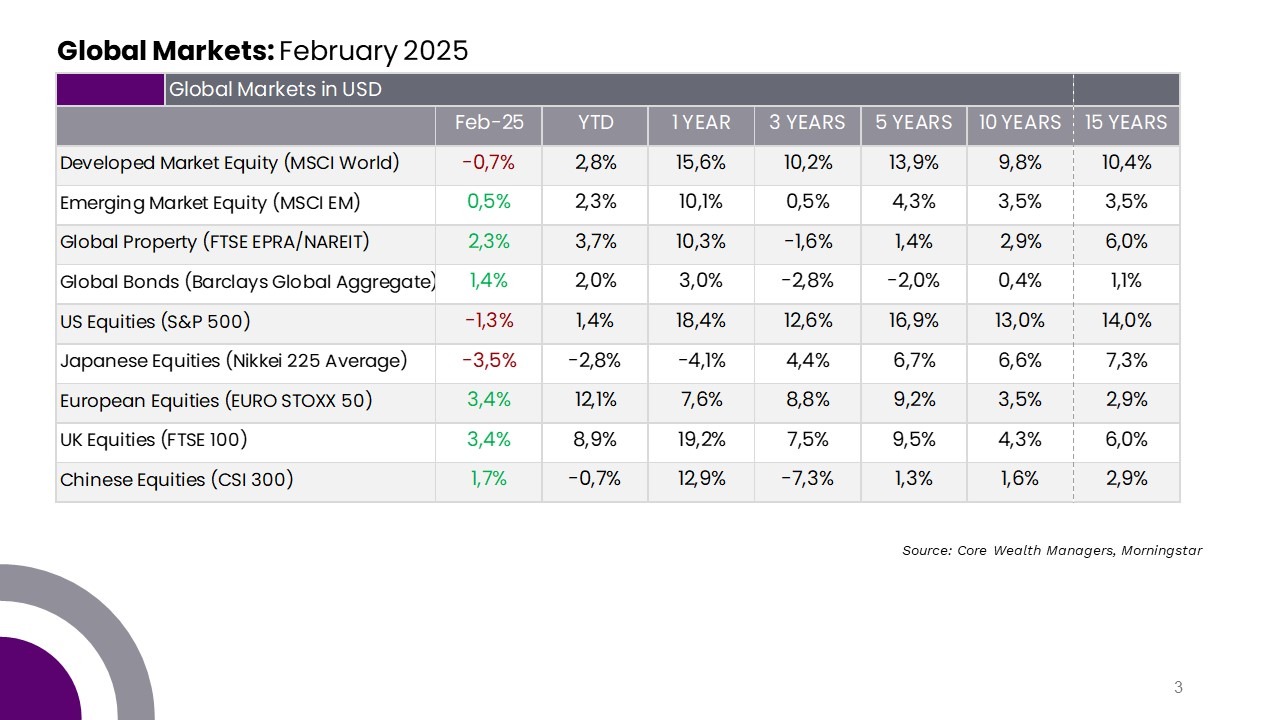

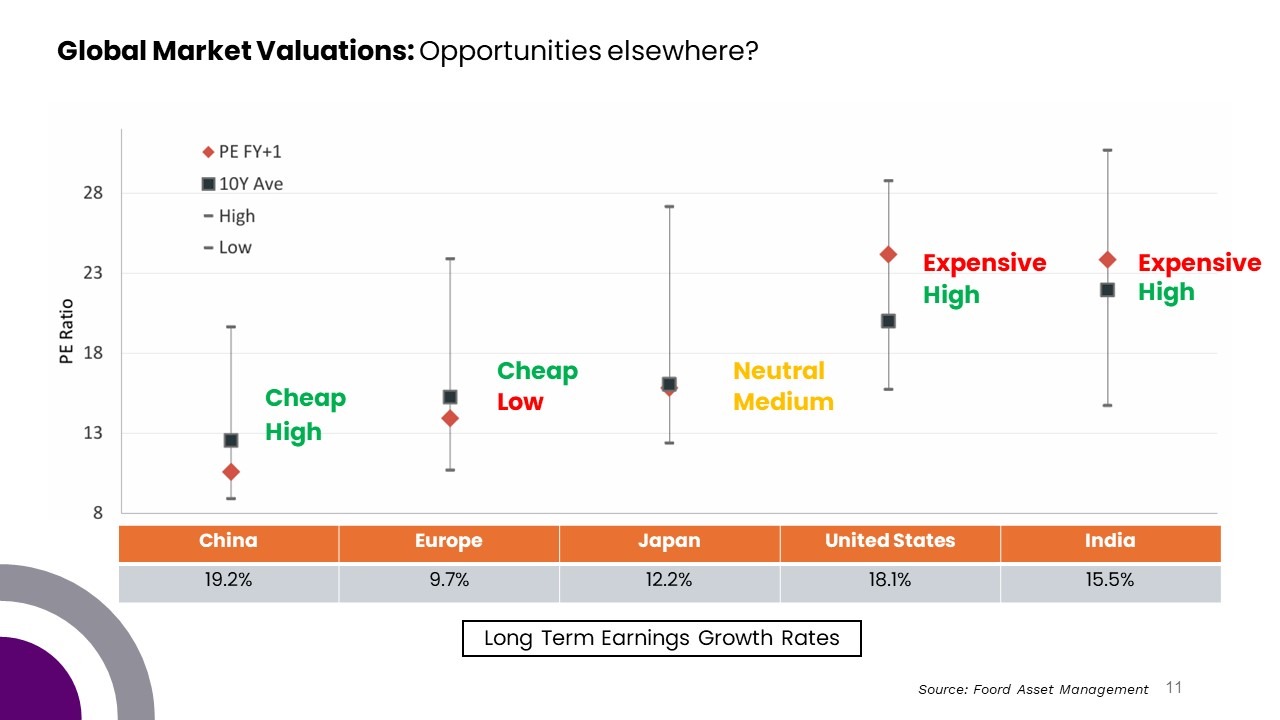

Despite looming tariff threats, European equities extended their rally, posting a 10th consecutive week of gains. Germany’s DAX, France’s CAC, and the FTSE 100 advanced by +3.8%, +2.0%, and +1.6%, respectively. Investor sentiment remained buoyant, driven by the perception that U.S. tariffs were less damaging than anticipated. Additionally, attractive valuations, stronger-than-expected corporate earnings, and the prospect of further European Central Bank intervention further supported the market.

- US Uncertainty

Concerns over the Trump administration’s policies and rising unemployment weighed on consumer sentiment in the U.S., reflected in the latest consumer confidence index, which posted its sharpest decline since August 2021. Major U.S. indices struggled, with the S&P 500, Dow Jones, and Nasdaq falling by -1.3%, -1.6%, and -4.0%, respectively. Further dampening sentiment, inflation data surprised to the upside, with headline inflation rising 3.0% year-over-year (YoY) and core CPI climbing 3.3% YoY. These inflationary pressures, coupled with concerns over Trump’s policies, have delayed the Federal Reserve’s plans for rate cuts. Furthermore, Fed Chair Jerome Powell reiterated in his congressional testimony that rate cuts are not imminent.

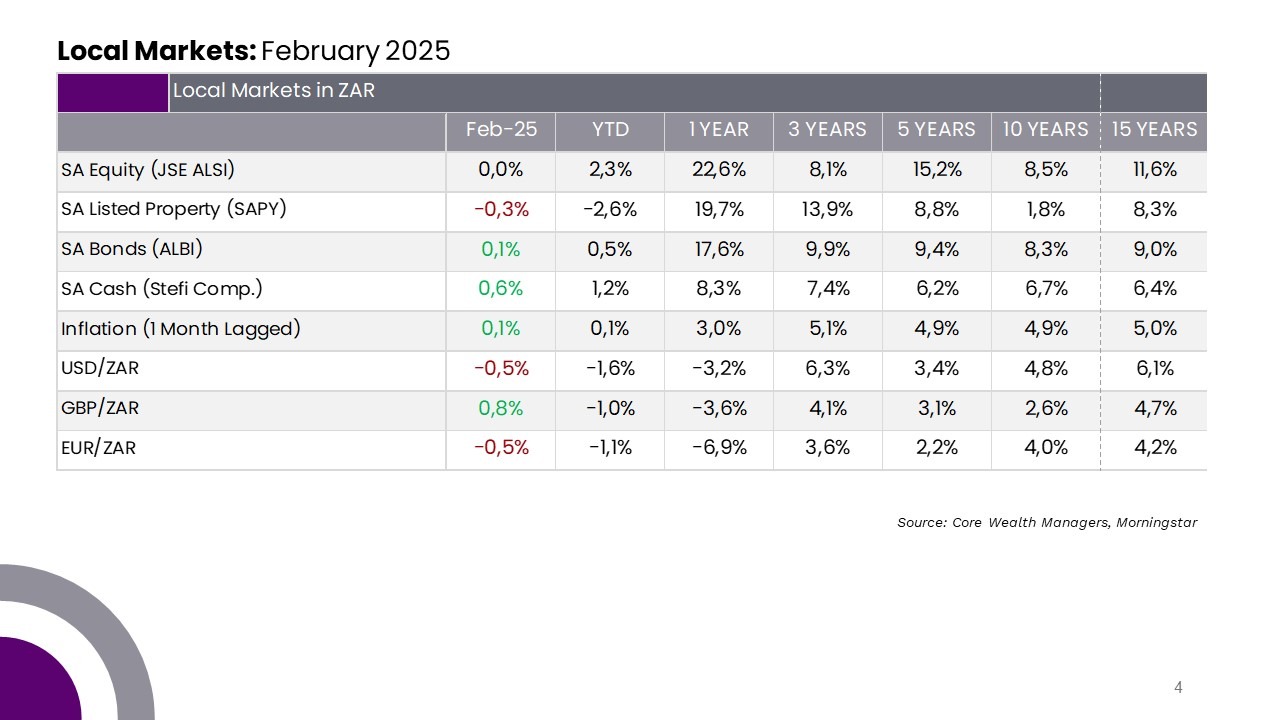

- South Africa under US scrutiny

Despite both local and global headwinds, the JSE/ALSI ended the month flat (+0.0% MoM). On the international front, President Trump’s perception of South Africa’s land reform policies as discriminatory led to his decision to cut USAID to the country. Domestically, uncertainty intensified as the budget speech was postponed to March due to disagreements within the Government of National Unity (GNU), particularly from the Democratic Alliance (DA), over a proposed 2% VAT increase. As the government prepares for the upcoming budget, it must address a R58 billion revenue shortfall to finance increased expenditures, including the social relief grant and a 1% wage bill hike. VAT remains the second-largest source of tax revenue, behind personal income tax and ahead of corporate tax. While global bonds yields generally softened during the month, South Africa’s 10-year borrowing rate rose to 10.5% p.a.